In this guest post, head of ad monetisation at GameBiz Consulting, Božo Janković shares his insight on better understanding one of ad monetisation's 'favourite' metrics.

Rather than being a simple case of just 'following the numbers', understanding the subtleties of each unique situation is essential to make sense of eCPM's bigger picture

Let's get started…

___________________________________________________________

eCPM is the most useless metric in ad monetization, yet it attracts the most attention among ad monetization managers and senior staff in game development studios.

Working in the mobile, free-to-play video games industry for over seven years now, some of the most common questions I’ve heard from colleagues working on ad monetization, leadership team members, and my clients concern eCPM.

"I heard that this game has $20 eCPM, and we only have $12. What are we (or you) doing wrong?"

Or…

"Our game X has $10 eCPM, and our game Y has $6. Why are we not working more on achieving the same eCPM?"

In this piece, I will try to argue why eCPM is the trickiest and, hence, the most useless metric in ad monetization if it’s observed outside of the proper context.

Read on to learn about the essence of eCPM, how it works and what are the top ten things that you should know before having discussions about eCPM with your colleagues (or a boss!).

Let’s start with the basics and dig deeper into this topic. First things first.

What is an eCPM?

eCPM stands for Effective Cost per Mile. It is a metric that tells us how much money we are earning per one thousand impressions (ads) shown to our players. It averages out our earnings over thousands and millions of ads that we show, since the value of those advertisements mostly comes from the installs and other actions our players do, not because a player merely watched an ad.

In the next several points, we’ll go over different basic factors that impact the eCPM and must be taken into account when trying to compare two eCPM values. Later on, we will cover more advanced factors too!

Part 1: Basic factors

#1 Ad format

This is probably the most obvious one, and it’s important for a reason. Different ad formats have different eCPMs by default, so it doesn’t make sense to compare eCPMs if we are not observing the same ad format.

It’s well known that banners have the lowest eCPM, while rewarded video ads and interactive ads have much higher eCPM. Where is this difference in eCPM across different ad formats coming from one? It’s simple. It originates from the different nature of these ads. The reason that rewarded video and interstitial ads have an eCPM that is so much higher than banners is that they are more visible, they take up the entire screen, they are in a very interactive medium - video or nowadays often a playable ad, they have a very visible call to action in the end so they attract much more player attention and the chances of the successful conversion are much higher.

Depending on the mix of ad formats used and how they are used, the eCPM of the game will be very different. With that in mind, when comparing eCPMs between different games, the only way it might make sense to compare is if we are talking about the same ad format.

#2 Country

This is an easy one. No matter which format we are talking about, eCPM will be very different, depending on the country. eCPM tends to be much higher in countries such as the United States of America, Germany, and Japan than in countries such as India, Egypt, Brazil and Serbia. This is purely for economic reasons since the players coming from the first group have a higher buying power (all of this, on average, of course), and so, these players are more valuable to the advertisers.

When comparing eCPMs between different games, the only way it might make sense to compare is if we are talking about the same country.

#3 Platform

This used to be an easy one. A few years ago, it was well known that the players on iOS have, on average, higher eCPM than players on Android. Similar to the previous point, an iPhone user has, on average, paid more for their device than an Android user, meaning that they have higher purchasing power and are for that reason more valuable to the advertiser since they are more likely to pay and are likely to pay more.

However, it’s not that simple anymore. Since Apple effectively deprecated IDFA, campaigns for iOS became less effective, and therefore, the conversion is less likely to happen. Nowadays, it's common to find games where eCPM is higher on Android. When comparing eCPMs between different games, the only way it might make sense to compare is if we are talking about the same platform.

#4 Scale

This should be easy to explain, even to someone who’s not necessarily familiar with the mobile advertising industry and is, for example, more focused on the in-app purchase side of things.

We’ve all been there; the game is going through its first days on the market, we start acquiring players to test the game, and we may have the first few thousand installs. Retention is great, ARPU is too, CPIs are not that bad, and it seems like we have a hit on our hands.

However, as we start to scale, things start going sideways. CPIs are rising, and retention and ARPU are not doing that well anymore. All of a sudden, we are questioning profitability and whether we can make this game a success or not. Sounds familiar? The thing is - you can achieve almost any benchmark for almost any game KPI on a low scale, but when it gets big, that's when the problems start.

The same thing happens with ad monetization. Optimizing eCPM is not the same when you have tens of thousands, as it is when you have hundreds of millions of impressions per day. The variety of ads being shown to players also comes into play, as does the chance of an install happening.

When comparing eCPMs between different games, the only way it might make sense to compare is if we are talking about approximately the same scale.

#5 Mediation setup

Here are two examples from the opposite sides of the spectrum.

One game is using only one ad network to show ads to its players. The other game has a complex mediation setup that includes several ad networks, both bidding and non-bidding, waterfalls with 20 to 60 instances with different eCPM floor prices, bid floors, segments and tiers.

In the latter, there is much more demand and competition among ad networks. Increased demand and competition between networks are what drive eCPM up. Mediation setup and its constant optimization is very important in maximizing ad ARPDAU by increasing eCPM and is something that many developers are doing. It absolutely makes sense to constantly optimize the mediation setup, run AB tests, and perform other activities aimed at finding a superior mediation setup, but it’s important to be aware of and acknowledge the other factors, too.

Most of the conversations around the industry about eCPM are focused on this point - comparing eCPM and mediation best practices to try to improve the eCPM, and that’s only natural. However, many other factors seem to be put aside or completely ignored, which may lead to the wrong conclusion - if one game has 5x lower eCPM than the other, it doesn’t necessarily mean it’s doing anything wrong - it’s possible that other factors are causing that difference and not the mediation setup per se.

The next set of factors is not something that is often talked about, especially when having a conversation with C-level executives who, more often than not, don’t have time for a broader context and just want quick, simple, and precise answers. Truth be told, even among professionals on the subject, these factors are not often discussed in casual conversations about eCPM.

Part two: Advanced factors

#6 Player age (in the game)

This is a very intriguing one. Based on the data I’ve seen, players who spent more time in the game have a lower eCPM than “fresh” players. Funnily enough, these players are likely to be the most valuable players on the IAP side of things because they have the best retention. It’s not unlikely that they have longer and more frequent sessions and are probably more likely to pay. Why is their eCPM lower then? I have a couple of hypotheses on this.

- These players have been in the game for a long time (or at least longer than someone who is on their Day 0 or Day 1). If they are regular or frequent ad viewers, they’ve already seen many of the ads we are serving, and it might be the case that they are becoming repetitive (I think we’ve all had this happen to us - the game we are playing is frequently showing the same ad over and over again).

Chances are that, if the player hasn't installed the app after they've seen it for the first five times, they won't do it after twenty impressions either. - Another explanation is that these players are very committed, very devoted to our game and they simply don’t take much interest in the content of the ads they are being served. They are simply doing it to get in-game rewards. When we talk about rewarded video ads (or in the case of interstitials, because they don’t have a choice) and no matter which ad we show, we are unlikely to grasp enough of their attention to make that install happen.

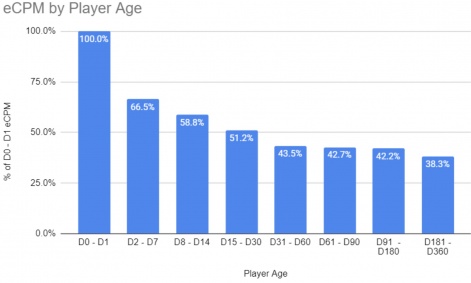

This data is not something that ad mediation providers have access to unless developers send them information about players’ ages in the ad request. For that reason, this data is not readily available and not often seen. Below, we can see an example of how eCPM behaves in one game, depending on the player's age. The data is for October 2023, rewarded video ads only, Android only, and United States only.

To keep the absolute numbers confidential, I’ve taken Day 0 - Day 1 here as 100%, and then all other data shows % of that original eCPM value. By now, you've caught on that absolute numbers don’t mean much…

We can see a few patterns:

- Players who have been in the game for around half a year generate only 38% of the eCPM compared to players who just installed the game. So, their eCPM is more than 2.5x lower.

- The eCPM value has already been cut in half for the D15 - D30 group.

- The biggest drop is from the first to second age group. After that, the decline is much less dramatic between the two neighboring groups.

It’s important to note that this doesn’t necessarily mean that these players are the least valuable from the ad monetization perspective. Since these players are likely very engaged with the game, since they are sticking around, it’s not unlikely that they are also engaged with ads more so than the average player and that they are watching more ads and have higher Impressions/DAU count. The difference in impressions/DAU might be large enough (if the system design of ads allows, of course) to make up for the eCPM difference.

All this brings us to the conclusion that we are not comparing apples with apples when we talk about two different games, where one of them has 50% of its players on their D0 - D3, and almost none of them D30+ while the other has 10% of D0 - D30 and 40% of them D60+. When comparing eCPMs between different games, we would ideally talk about the same player age.

#7 Usage rate

A very important metric, available on the mediation dashboards and yet, somehow, completely overlooked in conversations about eCPM.

Usage rate shows how many ads are shown on average to a player that watched at least one ad (also reported as Impressions/Daily Engaged User or Impressions/DEU, where engaged user means watched at least one ad). Why is this metric so important? The reason is simple - eCPM decay. With every single ad that we show to a player, the likelihood of them making an install, on average, decreases significantly. For that reason, the eCPM is, on average, higher for the first ad shown to the player than for the tenth one for any given day.

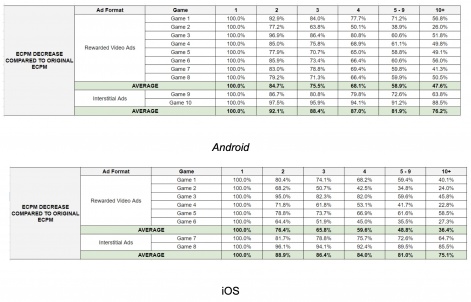

Here’s some data to back up this claim. All data is for October 2023, Android and iOS (separately), rewarded video ads, and interstitial ads (separately), United States only.

You can download a higher res version of this image here.

Notice a few things:

- For every single game, the next impression is worth less than the previous one (true for Android and iOS, rewarded and interstitial).

- Android seems to be somewhat more resistant to eCPM decay.

- Interstitial ads seem to be much more resistant to eCPM decay. The difference is very large. I would love to hear from you if you have any hypotheses as to why.

- eCPM decay from the previous to the next impression doesn't increase or decrease compared to the previous pair of impressions. There is no trend - the numbers are similar no matter if we compare 1st and 2nd or 4th and 5th impressions.

When comparing eCPMs between different games, we would ideally talk about the similar usage rate.

#8 Blocking strategy

Ad Monetization Managers have different options when it comes to controlling which ads are shown in their games. Even though it’s impossible or at least greatly impractical to control every single ad shown to the players, there are some tools that allow a certain level of control. It’s possible to block broadly, from whole categories (politics, religion) to specific genres (puzzle, casino) or in finer detail where you target a single problematic app or even just one specific campaign.

Generally speaking, the more restrictive the developer is with their blocking settings, the fewer advertisers there are to compete for the ad impression, meaning less competition and potentially lower eCPM. Of course, it’s not the same if a few main competitors are blocked along with the most sensitive categories or if a few genres that are known as the big advertisers are completely cut off from showing their ads in the game.

When comparing eCPMs between different games, we would ideally discuss how extensive our blocking strategies are.

#9 Player source (aka your User Acquisition)

If you’ve been lucky enough to have your game featured on the Apple App Store and/or Google Play Store in one of the more prominent spots on the store (for example, hero banner featuring), you’ll easily relate to this.

The featuring might bring a big increase in organic traffic, but at the same time, you’ll notice a decrease in retention, monetization metrics, and pretty much every other KPI. Why? The game is more visible in the store and is attracting more “random” players who are not necessarily looking for the experience your game offers. They try it out for a bit, and then they’re gone.

This is just one example of how players might differ in quality. The same goes for ad monetization metrics. Depending on what kind of players your game is getting at the moment (more organic, more paid, and within paid, what kind of campaign we are talking about), you’ll see different eCPMs, even for players on the same platform and country. Cheap installs coming from low-CPI campaigns will generate low eCPM and vice versa - players coming from campaigns optimized towards more challenging in-game events (purchase, retention, etc.) will be paid more expensively on the UA side and will also be generating higher eCPM on the ad monetization side.

As a consequence, two identical games on the same platform, in the same country, and with the same ad format and mediation setup could have drastically different eCPM depending on the player source and quality.

When comparing eCPMs between different games, we would ideally discuss where the players are coming from and what type of UA campaigns are running at the moment.

#10 Advertiser side (aka other games’ User Acquisition)

Apart from your user acquisition, which will influence eCPM through the quality of players it brings, a big factor in eCPMs will be the demand side of the coin. Have some advertisers increased, decreased, or completely shut down their budgets? Have they blocked your game for some reason? For Ad Monetization Managers, the demand side of the equation can be a great unknown, a tenth nail in a coffin in understanding the nuances of the beast we call eCPM.

As you may have picked up by now, even when you talk about the same ad format, country, platform, scale, similar mediation setup, player age, usage rate, similar blocking strategy, and player source, there still might be that unknown factor that makes comparisons of eCPM between different games completely inappropriate.

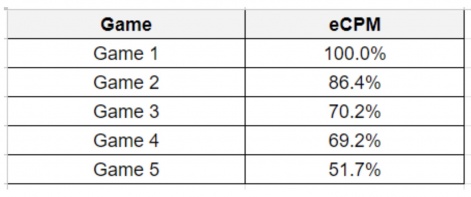

To demonstrate this, below, I’m showing data for five games from the first half of November 2023. Here’s the trick: All the games are from the same game genre, the data is for rewarded video ads only, United States only, Android only, the scale is similar, the mediation provider and all ad networks are the same, and the optimization strategy is the same, player age hasn’t been filtered out but due to the nature of the games, there shouldn’t be vast differences there either.

Usage rate factor is excluded because we are only looking at the very first impression for that user on a specific day. No ads are blocked from these games, except sensitive categories, all traffic is organic and still, the lowest eCPM is 2x lower than the highest one. This is a fun one to explain, isn’t it?

As a general rule of thumb, great caution is necessary when comparing eCPMs of two different games. Even though all those quarterly industry reports on eCPM values can be interesting to check out, they should be taken with a huge grain of salt (better make that a bag of salt!).

The fact that one game has a higher eCPM than another doesn’t mean it’s doing a better job at mediation optimization.

Instead of comparing absolute numbers, it makes much more sense to discuss the strategies we are using to optimize mediation and other ad monetization setup elements in our efforts to maximize the value ads bring to our business.