The SNJV has released its yearly report on the state of the French games industry, following surveys of 577 developers between February and June 2023.

It reveals insight into the state of French games companies throughout 2022, the year when mobile revenue decreased for the first time. Among the SNJV’s findings were that 1,257 video games were under development in France during 2022, 76% of roles were with permanent contracts, and 27% of studios generated over €1 million.

Vive la difference

Of the games in production, 854 (68%) of titles were based on new IP. Meanwhile, 776 titles were released last year, a decline of 7% compared to 2020.

Interestingly, the number of blockchain games was on the rise, with 42 titles utilising the technology in development last year, up 4% from 2020.

As for the most popular platforms amongst French companies, PC games were the focus for 33.5% of devs, followed by home consoles at 22.8% and mobile with only 16.1%.

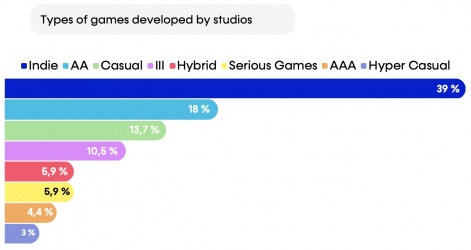

The number of hypercasual games made was even shockingly lower - considering their popularity worldwide last year. In France, just 3% of games in development were hypercasual, while hybridcasual represented 5.9%.

When analysing triple-A, double-A and indie, the latter saw the most releases, making up 39% of all titles developed.

Working in France

Of all French regions, it was Île-de-France that housed the most development studios last year, with 44.6% of the 577 total. This is unsurprising given the region surrounds French capital Paris, but perhaps more surprising is the comparatively fewer number of studios based in even the second most popular area: Auvergne-Rhône-Alpes in southeast-central France contained only 13.1% of the 577 devs last year.

On the employment side, tech-based jobs were most prevalent last year, making up 31.2% of the workforce, followed by design (23.5%) and visuals (22.6%). There was also a "significant increase in apprenticeships".

The number of devs to have made over €10 million more than doubled between 2020 and 2022 from 6.4% to 14.4%, and 27% generated more than €1 million. However, for the majority of devs in France (55%), revenues below €300,000 were seen.

The report also noted that publishers have gained more influence over the past few years in the local industry. In 2019, 39% of studios worked with a publisher, while in 2022, that figure rose to 62%.

The full SNJV report also looks at international performances and game budgets. A new Ipsos report, meanwhile, has found that 76% of French children have an explicit agreement with their parents about how much they can spend in games.