A new report by Newzoo examines media engagement, and has found that 60 percent of all engagement with media platforms occurs on mobile devices.

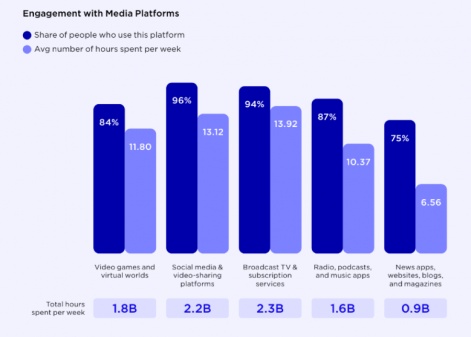

84 percent of respondents play video games or spend time in virtual worlds, for an average of 11.80 hours per week and a total combined playtime of 1.8 billion hours. This makes mobile gaming the fourth most popular form of media engagement, behind radio, podcasts and music apps (87 percent), broadcast TV and subscription services (94 percent), and social media and video-sharing platforms (96 percent).

However, despite being marginally less popular than radio, podcasts and music apps, video games and virtual worlds come third in terms of time spent, behind social media (13.12 hours per person per week, for a total of 2.2 billion per week) and broadcast TV (13.92 hours per person per week, for a total of 2.3 billion).

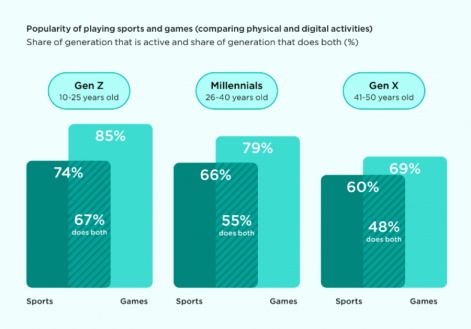

Compared to sports, consumers are more likely to opt for video games regardless of demographics, however the popularity of video gaming increases with each subsequent generation. However, sport is also increasing in prominence. 69 percent of Gen X consumers play games, compared to 60 percent who play sports and 48 percent who play both. Among millenials, 79 percent of consumers play video games, while 66 percent play sports and 55 percent play both.

85 percent of Gen Z consumers play games, compared to 74 percent who play sports and 67 percent who play both. Taken together, this suggests that there may be other factors at play, such as time and other commitments, as the percentages in all three metrics increases significantly in subsequent generations.

Mobile devices dominated consumer time in four of five media platforms examined. Social media and video-sharing platforms saw the largest share of consumer time on mobile devices, with 73 percent. This was followed by radio, podcasts, and music apps (68 percent), news apps, websites, blogs, and magazines (60 percent), and video games and virtual worlds (55 percent). Non-mobile sources pulled ahead in only one category, broadcast TV and subscription services, which saw 54 percent of consumers preferring other sources.

Mobile will continue to grow

Newzoo notes that “in the mobile-first era, IP holders will focus more on mobile-native engagement. Brands will increasingly add vertical videos, ads, product placements, and other elements to mobile games.” As such, it’s likely that the disparity will continue to grow, as more and more media producers and consumers alike turn to mobile.

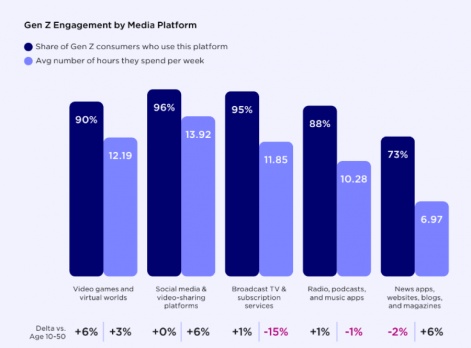

90 percent of Gen Z consumers play video games or spend time in virtual worlds, compared to 95 percent who watch TV or subscription services and 96 percent who spend time on social media and video-sharing platforms. However, those consumers spend more time playing games than watching broadcast TV or subscription services, with an average of 12.19 hours per week compared to 11.85 hours. This still falls behind social media, with consumers spending an average of 13.92 hours per week on such platforms.

However, gaming could continue to grow more prominent as a form of entertainment, with Newzoo noting that active engagement, such as gaming and reading, is becoming more popular with each new generation compared to passive forms of entertainment, such as watching television.

Newzoo notes that people engage with video gaming content in a variety of ways. 72 percent of activity time is active, with 47 percent playing video games, 13 percent creating content related to them, and 12 percent reading related news, blogs, websites, or social media posts. Passive consumption makes up an additional 27 percent of activity time, with 16 percent spent viewing gaming content and 11 percent spent listening to podcasts or radio shows about games.

Newzoo further states that there is significant potential for brands to “leverage the various touchpoints not only to build legitimacy around their presence in or around games, but also to create different kinds of content that amplify their message within the target group.” For example, car manufacturers can not only bring their vehicles to racing games, but partner with them more directly by “offering video and/or written racing advice to sim racers and providing tools for creators to customise their favourite cars from the brand to use in-game.” As such, brands which can successfully establish a gaming presence can bring their products to a wider audience, leaving them poised for future success.

Earlier this month, Newzoo released its predictions about the games market in the coming year.