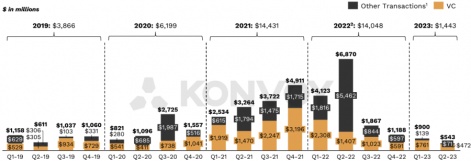

Venture capital funding fell 38% quarter-on-quarter throughout the games industry, reaching a total of only $472 million in Q2 2023 compared to $761 million in Q1, according to Konvoy’s latest Gaming Industry report.

This brings the cumulative total for 2023 so far to $1.2 billion, compared to $3.7 billion in H1 2022. This QoQ fall was largely driven by a 60% drop in growth funding, from $329 million to $131 million. For the sixth consecutive quarter, Konvoy doesn’t report any late-stage funding.

There was also a significant decline in gaming funding, which fell 40% from $900 million to $543 million - the lowest figure since before 2019. However, this doesn’t include M&A activity, and the report notes more optimistically that the industry is still forecast to reach a market valuation of $201 billion this year, representing a 9% increase from 2022.

The number of VC deals in Q2 2023 also hit their lowest number since Q3 2020. A total of 85 deals were signed in Q2, of which 77 were early-stage and eight were growth deals. In contrast, Q1 saw 103 early-stage deals and 6 growth deals being struck. This brings the total for the year so far to 194.

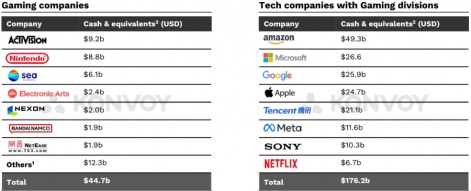

Konvoy reports that the games industry currently enjoys a healthy M&A environment, with public gaming companies holding $44.7 billion in cash and cash equivalents. King parent company Activision Blizzard had the highest cash reserves of all gaming companies, at $9.2 billion, followed by Nintendo at $8.8 billion and Sea Group at $6.1 billion. Other mobile mainstays among the industry’s top performers include Electronic Arts ($2.4 billion), Nexon ($2 billion), Bandai Namco and NetEase ($1.9 billion each).

Tech companies proved even more lucrative still, with a cumulative $176.2 billion in cash and equivalents. Amazon came out on top with $49.3 billion - almost twice the second place company, Microsoft, which had $26.6 billion. Google came in third with a total of $25.9 billion. Top mobile game makers Tencent ($2.1 billion) and Netflix ($6.7 billion) are also identified as top performers, alongside phone manufacturer Apple ($24.7 billion) and Sony, which is hard at work establishing its own mobile division ($10.3 billion).

Success by region

Asia proved to be a particularly lucrative market for investment in Q2, with a total of $221 million in venture funding. Of this, $138 million went towards early-stage funding, compared to $83 million towards growth.

North America came in second place with $141 million, $98 million of which went to early-stage investments while $43 million went towards growth. Europe was the only other region to exceed $100 million, with a total of $102 million divided into $98 million for early-stage investment and $4 million for growth.

Australia drew only $7 million in early-stage investment, while South America saw just $1 million. Neither region saw investment in growth, and no deals were reported in any other markets.

Asia also saw the highest number of deals at 38, giving the region an average deal value of $5.8 million. This was followed by Europe with 23 deals, for an average deal value of $4.4 million. With 21 deals, North America saw the highest average deal value at $6.7 million.

We listed several of the companies in this article as some of the top 50 mobile game makers of 2022. We'll be unveiling our list for 2023 in the coming months.