Activision made $19 million from mobile games during 2018.

That’s hardly enough to qualify as a rounding error compared to $7.3 billion of overall bookings Activision Blizzard generated during the year.

The difference in scale does, however, contextualise the size of the task the company faces as it attempts to put the words of president and COO Coddy Johnson - “mobile is a top priority for us” - into action over the coming months and years.

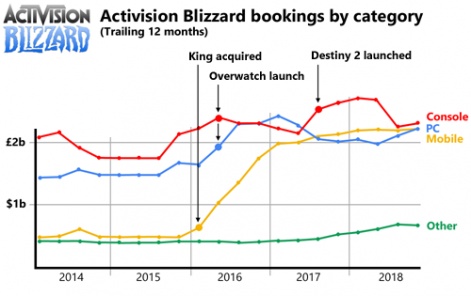

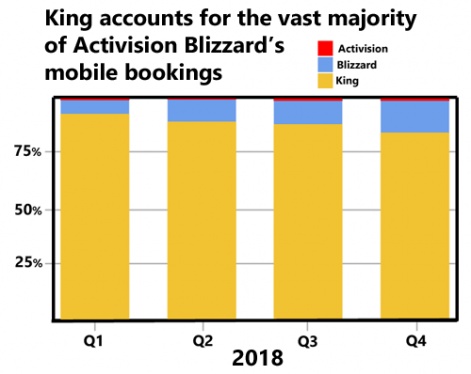

This isn’t to ignore that Activision Blizzard contains a growing mobile games business. The $5.9 billion acquisition of King in late 2015 has proven to be a fine commercial move.

Mobile games now account for the same proportion of revenue as console and PC games, although not quite so profitably.

Yet, three years on, the King acquisition doesn’t appear to have had much impact in making Activision or Blizzard more mobile-focused. Nor, despite many attempts, has King managed to break out of the match-three genre.

Sure, Blizzard has a decent mobile track record, generating $222 million in bookings from its cross-platform collectible card game Hearthstone during 2018.

But as the reaction to Diablo Immortal's announcement at Blizzcon 2018 demonstrated, creating mobile games based on existing IP remains a tricky proposition in terms of aligning the vagaries of fanbase anticipation with the stark realities of free-to-play mobile game design and monetisation.

Going Chinese

That Activision Blizzard has licensed Call of Duty and Diablo to Chinese companies - Tencent and NetEase respectively - in the hope of making them into mobile hits speaks volumes.

Indeed, another Chinese company - Elex Wireless - has been working on a strategy/4X game using the Call of Duty licence for a couple of years. Call of Duty: Global Operations has been in soft launch testing on Android since late 2018.

Activision has also licensed the otherwise dormant Skylander IP to Korean publisher Com2uS, which has turn-based RPG Skylander: Ring of Heroes in soft launch.

Of course, given mobile is the biggest single games sector by annual revenue ($50 billion-plus), and China/Southeast Asia the biggest single mobile gaming territory ($25 billion-plus), Activision Blizzard’s decision to have some of the most successful Asian mobile games developers working on its key licences is to be expected.

The King acquisition doesn’t appear to have had much impact in making Activision or Blizzard more mobile-focused.

Nevertheless, given Diablo Immortal’s reception, it will be interesting to see how - or if - this focus on Asian commercial success can be balanced against the potential for Western reputational damage, especially given the strong pay-to-win demands of the Chinese market.

Blizzard need wizards

This is particularly relevant for Blizzard; a company already experiencing morale issues in terms of upper management changes, a brain drain of senior talent and more generalised job losses.

Given its historic PC focus, Blizzard is the least open part of Activision Blizzard to mobile gaming mores such as F2P monetisation and metagame-over-gameplay design loops.

Franchises such as WarCraft, StarCraft, Diablo and even Overwatch aren’t amenable to being ‘taken mobile’ in any holistic sense.

In this context, then, Blizzard’s best bet for mobile success is likely the under-performing Heroes of the Storm. As an already mashed-up-IP featuring characters from across Blizzard’s discography, only it looks like providing the flexibility required to successfully combine IP and monetisation in a mobile-friendly manner.

Franchises such as Warcraft, Starcraft, Diablo and even Overwatch aren’t amenable to being ‘taken mobile’ in any holistic sense.

It helps that Western-developed games in this genre such as Star Wars: Galaxy of Heroes and Marvel: Strike Force provide a template for success.

Calling out Call of Duty

The situation for Activision when it comes to mobile game is different but no less challenging.

Surprisingly, perhaps, it has a long history of mobile games. Although it only has a Call of Duty Companion App and 2011’s Call of Duty: Black Ops Zombies ($6.99) currently live on app stores, over the years it has set up (and closed down) internal and external mobile game studios, launching (and canning) over 20 mobile apps, including six Call of Duty games.

That these games were unsuccessful meant Call of Duty fans didn’t even notice their existence, however.

This may have saved Activision from a Blizzcon-style backlash, the fact it couldn’t leverage Call of Duty’s brand to make Call of Duty mobile games successful suggests a strong disconnect between core fans and mobile gamers that even Tencent (or King, also thought to still be working on a Call of Duty game) will find it hard to overcome unless they can pull off Fortnite-style crossplay.

So, despite the latent power of licences like Call of Duty and Diablo, it’s difficult to see how Activision Blizzard can translate its “mobile is a top priority for us” from being a well-meaning soundbite into something commercially substantial, at least via organic growth.

Yet it’s also worth pointing out mobile games are a mature sector. That makes it very hard to launch new products into the top grossing charts, which is why Supercell kills so many games. But it also underlines the valuation of developers who have already demonstrated successful products.

Given it’s holding more than $2.5 billion in net cash, perhaps Activision Blizzard’s best bet for demonstrating the importance of mobile would be another King-scale acquisition.