InvestGame’s Gaming Deals Activity Report Q1’22has revealed the tempo and potential fractures in the state of 2022 M&A in the games industry, including the influence of blockchain gaming among private investment, and mobile stepping up from the considerable decline in gaming investment activity.

Still waiting on Microsoft, Take-Two, and Sony

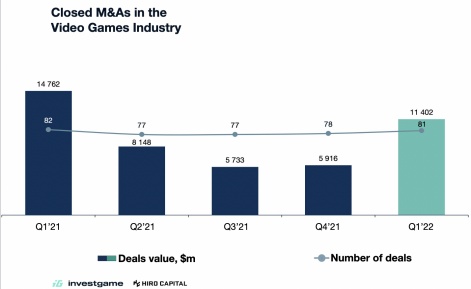

Although the number of closed deals in Q1 2022 (81) was near parity with 2021 (82), the value of closed deals in 2021 is significantly lower – $11.4 billion in 2022, compared to $14.7 billion.

It is worth mentioning that 2021 figures are primarily bolstered by Microsoft’s $7.5 billion acquisition of ZeniMax, while five deals provided 68 per cent of 2022 total deal value: Embracer acquiring Asmodee for $3.1 billion, SteelSeries’ acquisition by GN Store Nord for $1.2 billion, Tencent’s acquisition of Sumo Digital for $1.3 billion, MoPub by AppLovin for $1 billion, and ESL being acquired by Saudi Arabia’s Savvy Gaming Group for $1 billion.

Regardless, this is exceptionally unlikely to represent a downward trend in 2022 M&A, which will see dramatic upswings in Q2 onwards, should the Microsoft/Activision Blizzard ($68.7 billion), Take-Two/Zynga ($12.7 billion), and Sony/Bungie ($3.6 billion) deals complete, let alone the current drive for further consolidation.

Blockchain gaming drives private investment

Private investment has escalated considerably between Q1 2021 and Q1 2022, both in the number of deals (146 to 174) and deal value ($2.3 billion to $3.2 billion).

Within this, blockchain-related gaming has attracted around 50 per cent of private investment deal value, drawing in $1.6 billion across 85 deals. Three of the top five deals are linked to blockchain: the $450 million seed round of Yuga Labs at $4 billion valuation, Animoca round of $359 million at $5 billion valuation, and the $200 million Immutable Series C round, valued at $2.75 billion.

The remaining two top deals were mobile-focused: Dream Games’ $255 million Series C round at $2.75 billion valuation, and thatgamecompany raising $160 million from TPG and Sequoia.

Mobile steps ahead of pure gaming investment decline

However, gaming investment activity in pure gaming companies has declined from 96 deals valued at $2.7 billion in Q1 2021 to a significantly slimmer $1 billion across 52 deals.

InvestGame speculates this represents “faded interest of investors in pure gaming companies, what with the rising interest in blockchain-powered gaming, combined with the generally harsher market conditions of today”. Within this, the mobile industry represents the most active sector, with $600 million across 23 deals.

Very few voices within the mobile games industry predict a decline in the hunger for M&A. In the first of his new monthly column for PocketGamer.biz, Ampere Analysis’ Piers Harding-Rolls looks at the biggest drivers and outsider influence behind Q1 2022 M&A.

You can also check out our list of the 10 biggest M&A deals in the games industry through this link.